OUTsurance Funeral Cover Review

OUTsurance Funeral Cover at a Glance

- Strong corporate social responsibility initiative

- Active in South Africa, Namibia, and Australia

- So far has paid out R3 billion in Outbonuses

What we like:

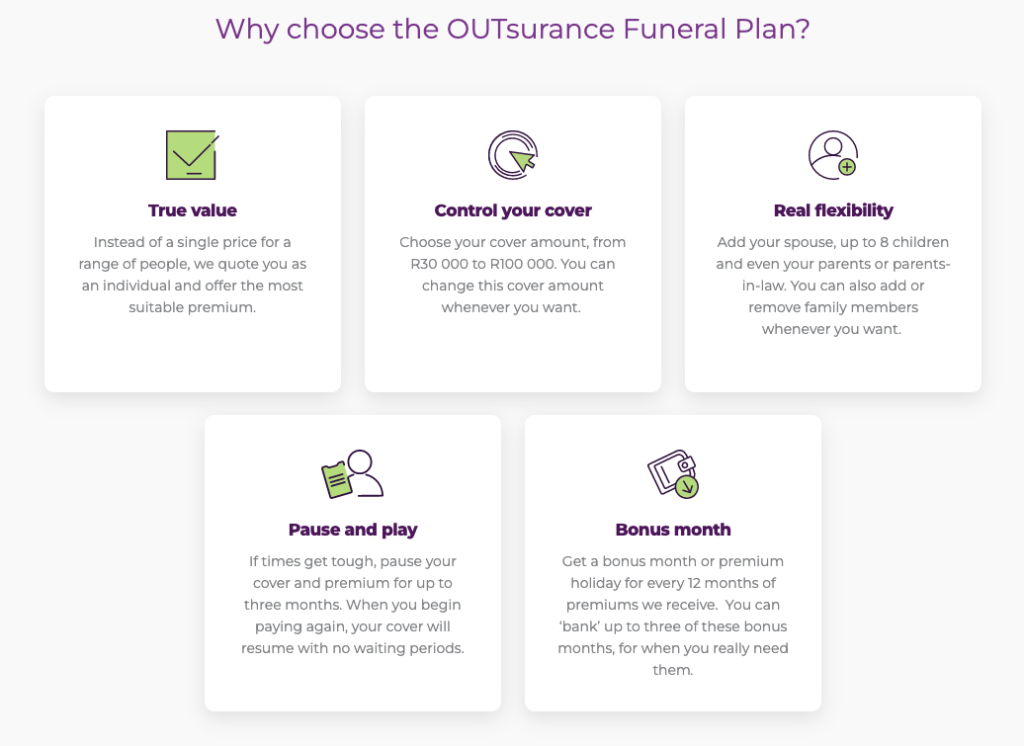

OUTsurance’s funeral cover plans offer great flexibility when it comes to payment and benefits. Their plans cover up to 13 family members including elderly people and children. Additionally, the cover does not lapse once your children turn 21. There are accommodations for tough financial times such as their 'pause and play' and 'bonus month' benefits. OUTsurance also offers cashback in the form of their 'Outbonus' programme.

Best for:

The OUTsurance funeral cover is best for people under the age of 65, with families to support. Depending on the type of cover you'd like, their plans may be more suited to those who earn well. The plans are also great if you're looking for cover for your parents who may have retired, or if you've already got an idea of the funeral expenses your loved ones might incur.

- Flexible, affordable cover for people between the ages of 18 and 69

- Pause your cover if you're in a financial pinch.

- Easy to get a quote.

- The waiting period of six months in the event of natural causes.

- There is an entry age limit of 20 years for kids and 69 years for adults.

Funeral cover is often confused with life cover but differs in that it is money that is solely set aside for funeral-related expenses. This means the payment is much faster, the entire payment is usually made as a lump sum. Funeral cover is a great way to ensure that you and your loved ones can have peace of mind in the event of an accident or natural causes.

Let’s review OUTsurance’s funeral coverage including its benefits, drawbacks, pricing, and overall coverage!

What makes OUTsurance Funeral Cover different?

OUTsurance funeral cover stands out because the coverage and premiums are very much tailored to the customer and their budget. There are also specific plans for pensioners who may otherwise pay an extra fee, and plans that cater to your parents and in-laws.

Additionally, OUTsurance allows you to take out funeral cover both as a stand-alone policy and as a part of your existing life insurance cover. Given that we’re all feeling the pinch, OUTsurance’s ‘Pause and Play’ benefit is a great initiative as it allows you to stop your cover for a maximum of three months. They also offer a ‘Bonus Month’ which allows you to skip one month’s premium after paying a consecutive 12 premiums.

OUTsurance Funeral Cover coverage options and benefits

As mentioned, OUTsurance funeral cover is really tailored to the needs of the customer, so there are a number of coverage options to explore. Before you decide on a plan though, it may be best to speak to a consultant about your needs and affordability.

Stand-Alone Policy

OUTsurance’s stand-alone funeral cover policy allows you to get coverage even if you don’t have an existing insurance policy with them. The funeral payment amount your beneficiaries can claim is flexible.

They also offer a number of add-ons, for example, after-tears benefits, transportation benefits, and airtime benefits. This means that specific amounts of money will be allocated to these funeral expenses, making it easier for your family to budget their expenses without breaking the bank.

Parental Cover

If you have an existing life insurance policy with OUTsurance, you can add on a funeral policy specifically for your parents. The OUTsurance funeral plan currently allows for 13 family members to be added to your plan.

There is a limit of four parents that can be added to your plan, however, they can be either biological, adoptive, or your in-laws. Additionally, there is an age clause so they have to be 69 years or younger.

Pensioner's cover

OUTsurance Funeral Cover Pricing

One of the main perks of OUTsurance’s funeral plans is that they are extremely flexible when it comes to pricing. Whilst many factors come into play when determining your monthly premium, for example, age, the number of dependents, and affordability, the value of the payout is determined by you.

Ranging from R30 000 to R100 000, OUTsurance funeral cover can be tailored to suit you and your family’s needs. This final amount can also be adjusted in the future and covers up to eight family members. The final payout amount, the number of members on the plan, and additional benefits will determine the monthly premium.

Where can OUTsurance Funeral Cover improve?

Unfortunately, OUTsurance funeral cover only offers coverage for people under the age of 69. The cover is also not comprehensive, as certain benefits are charged separately. This can mean that your base cover may not be enough for all your expenses.

There is also a waiting period that is dependent on the cause of death. Accidental death is more likely to receive an immediate payout.

How do I request a quote for OUTsurance Funeral Cover?

It’s really easy to request a quote for OUTsurance funeral cover on their website, via their app, or telephonically. You will need to be over the legal age (18 years old) and have a valid South African Identity document.

If you’ve downloaded the OUTsurance app on your smartphone, you can simply request a quote by filling in their short online form. Alternatively, there is a similar form available on their website. And if you’d prefer to talk to an agent, you can call their call centre for a quote and guidance on the application process.

You won’t need any special documents for this process; questions will be based on your age, gender, income, contact details, and desired payout. If you already have an insurance policy with OUTsurance, you may want to check if your policy offers funeral benefits. To find out more about this, read through your life insurance policy or contact your broker to have a chat about your coverage.

Frequently Asked Questions (FAQ)

How does OUTsurance Funeral Cover work?

OUTsurance funeral cover is designed to cover solely funeral-related expenses. Like many other types of insurance, your premiums are determined by what you can afford and the benefits you’d like your loved ones to receive. Upon death, the funeral cover plan will pay out the entire lump sum and allocate benefits to cover the funeral expenses.

What is the maximum funeral payment?

The maximum funeral payment is currently R100 000 with a number of great additional benefits, for example, after-tears and tombstone benefits. The maximum funeral payment may be capped depending on your affordability.

How do I join OUTsurance?

Joining OUTsurance’s funeral cover is a relatively quick process. All you have to do is request a quote either online, via their app, or telephonically and an agent will be in touch to guide you through the rest of the process.

Other OUTsurance Product Reviews

Comments

No Spam, "drip-feed" or other BS email!

Get an email from us only when we can provide insights or offers.