1st for Women Insurance Review

1st for women Insurance at a Glance

- Offers insurance products tailored to South African women.

- Offers car, home, life and personal insurance.

- The 1st for Women Foundation helps address female abuse.

What we like:

It’s easy to get assistance with a quote. You can either fill out a short form on their website, providing your details, ID number and type of insurance you’re interested in. Alternatively, you can call their customer service number.

The policies have been designed after looking at market research and considering the socio-economic factors at play in the lives of South African women. Moreover, the company shows commitment to causes that are close to South Africans' hearts with the 1st for Women Foundation and the 'For Women' platform. These initiatives aim to raise awareness and funds for Gender Based Violence survivors, as well as provide a safe space for women to connect with relevant organisations.

Best for:

1st for women is a great option for women who are looking to get tailored insurance policies with a range of optional covers. No matter the type of insurance, there are options for every budget and policies generally have a specific consumer in mind. This makes it easy to find an insurance policy that suits you!

- 1st for women can make life easier with their Guardian Angel Assistance programme.

- Range of policies and add-ons to suit every budget.

- Cover can be extended according to your needs later on in life.

- There are multiple contact numbers depending on the purpose of your call, which can become confusing.

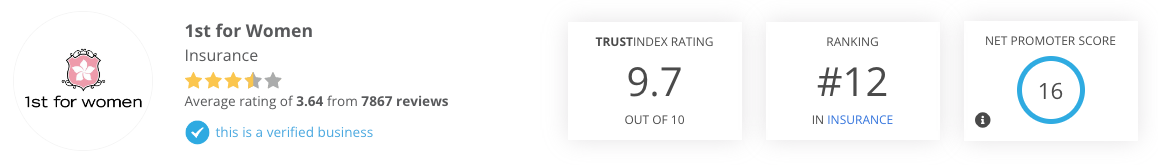

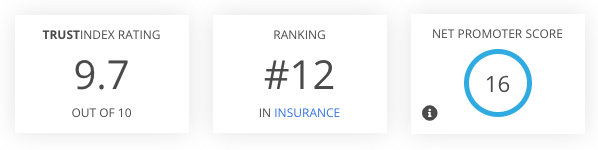

Reviews provided by Hellopeter

About 1st for women Insurance

Starting in 2004, 1st for women sought to create insurance policies that put the needs of South African women first. While the company initially focused on motor insurance, the company had expanded to life, home, contents, and personal insurance.

Why create insurance products specifically for South African women? Simply put, there is a unique insurance market for South African women! An impressive 60% of primary purchasers within households in South Africa are women.

Coupled with higher personal safety, and health concerns, South African women could definitely benefit from products designed with them in mind! This meant developing products like the ‘Guardian Angel Assistance’ programme, and their dread disease cover that protects you and your loved ones financially in the case of women-specific cancer, pregnancy complications and sexual assault.

1st for women's Products

1st for women Car Insurance

1st for women offers three tiers of car insurance, so there’s something to suit every budget. It doesn’t matter what gets you moving, 1st for women has an insurance policy for it! The company offers motorcycle, off-road, trailer and caravan insurance as well as watercraft insurance.

The comprehensive car insurance policy covers you in the event of theft, loss, accidental damage, and third-party and fire damage. Also available in this package is their Guardian Angel assistance programme, which offers a helping hand in emergencies.

The Third-party, Fire, and Theft Car Insurance policy covers you for just that! You can receive financial compensation in the event of fire damage, or theft. This package does not cover you for accidental damage, but 1st for women will cover any third-party costs that you are legally responsible for.

Lastly, 1st for women offers Third-party insurance only, this covers you in case you accidentally injure someone or damage someone else’s car or property in an accident.

1st for women Home Insurance

1st for women offers both home contents and buildings insurance so you can insure your property from the inside out! Their home contents insurance includes a comprehensive cover option, Fire and Storm Only option, and Handbag cover.

Comprehensive home insurance at 1st for women covers acts of nature, theft, and loss/damage. This means you can submit a claim if your home is damaged during a storm or natural disaster, broken into, or accidental damage. Uniquely, 1st for women insures you against damage from objects falling out of aircrafts and food spoiled by load shedding or power outages.

The company’s Fire and Storm Only Home Contents insurance policy offers cover in the event of all possible natural disasters. And their Handbag cover offers up to R25,000 for any loss, damage or theft of your handbag and its contents.

Their comprehensive buildings insurance policy covers structural damage caused by natural disasters, water damage, break-ins, and malicious destruction. This includes your home’s physical structure (walls, windows, roof etc) as well as your garage, outbuildings, swimming pools, perimeter walls and fences. There is also a geyser cover add-on, and the ability to increase your cover if you feel you need the extra financial cushion.

1st for women Business Insurance

When it comes to business insurance, 1st for women has a tailored approach. The company can offer you a quote based on your business and your needs. Their policies include:

- 1st for Business Women: Ideal for public-facing retail or service providers such as a coffee shop or hair salon owners. You will be covered for loss, damage, loss of income, and public liability.

- 1st for Professional Women: This policy is geared towards women-owned businesses that are registered with a professional body, for example, chartered accountants or engineers. You will be covered for loss and damage to your business premises, equipment and portable items.

- 1st for Executive Women: This insurance policy is designed to cover women in executive power positions from hindrances in their personal and professional lives.

- Errors and Omissions: Ideal for service and advice-based businesses or consultancies, this policy provides you with legal and litigation services.

- Directors and Officers: Offering legal services as well, this package is geared towards female directors.

- Business Assist: To help you keep your business running smoothly, the 1st for women business assist package can help you with financial advice, debt collection, emergency medical assistance, and even office assistance.

1st for women Life Insurance

1st for women’s life insurance policy offers up to R10 million in coverage, and it comes with no expiry date! The cover amount and terms can be adjusted down the road, and you can have up to 10 beneficiaries so your loved ones can all be taken care of.

Their life insurance policy is unique to your risk profile and needs, and you and add extra cover to your existing policy. These include:

- All Woman Dread Disease Cover: This optional cover financially protects you and your children just in case of a range of women and childhood-related diseases. This includes but is not limited to breast cancer, cervical cancer, ovarian cancer, brain tumours and pregnancy-related complications.

- Dread Disease Cover: This policy pays out a lump sum in the unfortunate event that you are diagnosed with a severe illness or need major surgery.

- Pure Life Cover: With a basic and elevated cover option, a lump sum will be paid out to your loved ones in the event of your death.

- Disablement Cover: If you are left disabled in an accident, 1st for women will help out financially without taking this amount out of your life cover.

1st for women Personal Insurance

Life is full of uncertainty, so 1st for women offers a host of personal insurance policies and add-ons. With their ‘Cash Back Plus’ programme which can be added on to any of their other policies, you can receive up to 25% of your premiums or your first year’s premium back in cash. All you have to do is remain claim free for four years!

1st for women allows offers the following add-on policies:

- Personal Accident Insurance.

- Cellphone Insurance.

- Tyre and Rim Guard.

- Extended Warranty.

- Pre-owned Vehicle Warranty.

- Legal Cover.

- Funeral Plan.

- Scratch and Dent.

- Auto Top-up.

- Pet Insurance.

- Guardian Angel Assistance.

MiWay Headquarter and Contact Information

- HQ Address: 1 Telesure Lane, Riverglen, Dainfern, 2191.

- Phone support: 0861 33 93 39

- Email: [email protected]

- Website: https://www.firstforwomen.co.za/

Frequently Asked Questions (FAQ)

Is 1st for women Insurance only for women?

No, 1st for women does not exclusively cover women. Men can also reach out for a quote or to chat about their insurance needs.

Who underwrites 1st for women Insurance?

1st for women falls under the Telesure Investment Holdings company. This company owns several popular insurance brands in South Africa such as 1life, Dialdirect and Budget Insurance.

How do I claim from 1st for women Insurance?

To start the claims process, you can call 1st for women on 0861 33 93 39. A consultant will guide you through the process, and explain what documents you’ll need as well as the next steps.

Other 1st for women Products

Comments

No Spam, "drip-feed" or other BS email!

Get an email from us only when we can provide insights or offers.