Auto & General Medical Gap Cover Review

Auto & General Medical Gap Cover at a Glance

- Flexible plans for a diverse range of budgets.

- 3 main medical gap cover options.

What we like:

Medical gap insurance is intended to help with the unexpected expenditures of hospital stays. The insurance will help to reduce some of the stress that this financial load might otherwise give you and your family. With Auto & General, this level of coverage is at your disposal at an affordable premium.

Best for:

For South Africans seeking reliable medical gap coverage, Auto & General is a viable insurance provider to consider. The Auto & General mobile app enables policyholders to access details about their personal and family funeral policies easily and quickly. Additionally, in case of unexpected emergencies, customers can utilize Auto & General's emergency assistance line at 0860 104 210 for immediate support.

- Offers three plans to suit various budgets.

- Easy online quote application process.

- Remarkable customer service.

- No discounts for loyal customers.

Health emergencies can happen anytime; sometimes, they happen when you are most unprepared financially. Have you ever been hospitalised for a treatment or illness requiring considerable care but not covered by your health insurance? These expenses can deeply hurt your finances. If you are in South Africa, Auto & General Medical Gap Insurance offers coverage for medical treatments that are more costly than the amount covered by your health insurance.

In this review, we’ll look deep into Auto & General Medical Gap Cover. You’ll learn about the advantages and disadvantages of getting the Auto & General Medical Gap Cover and its distinctive features.

What Makes Auto & General Medical Gap Cover Different?

Auto & General Medical Gap Cover pays out to cover the difference between the amount of money medical assistance pays and the total cost of in-hospital treatment. Even if you have medical insurance, you may be liable for paying out-of-pocket expenditures not covered by insurance, such as those spent at hospitals and by specialists who specialise in your disease. With Auto & General Medical Gap Cover, the coverage gap is eliminated.

Auto & General Medical Gap Coverage Options and Benefits

Auto & General Medical Gap Cover offers three options to choose from. They include the following:

Essential Gap Cover

Essential Gap Cover plan may pay up to 300% of the medical scheme price, which may be adequate to cover any treatment claim deficiencies. If you are involved in an accident and need treatment from a hospital’s emergency department or casualty unit, Essential Gap Cover will pay up to three times the maximum medical aid rate. This insurance covers up to R7,500 per policyholder per year for treatment obtained in a hospital’s associated casualty unit.

Comprehensive Gap Cover

Comprehensive Gap Cover pays an extra 500% of the medical insurance premium to bridge the cost gap associated with an authorized in-hospital surgical treatment. This medical gap insurance pays five times the maximum of the medical assistance tariff in the case of an accident that necessitates a visit to a hospital’s emergency room or casualty unit. With the comprehensive gap cover, the sub-limit benefit for internal prostheses is R20,000 per policy per year, and the co-payment benefit is up to R50,000 per year. Moreover, the coverage would pay you up to R50,000 in yearly out-of-pocket expenses for your internal prosthesis. The comprehensive gap cover also includes an R20,000 lump sum payout upon initial diagnosis of stage 2 or higher cancer and yearly coverage of R15,000 per policy for treatment at a hospital-affiliated trauma unit.

Absolute Gap Cover

Absolute Gap Cover at Auto & General Insurance offers seven times the limit of the medical aid tariff. This cover offers a co-payment benefit that is subject to the overall annual policy limit of R165,000 per insured per annum. Under the absolute gap cover, each policy has two annual copayments or deductibles of up to R15,000. In addition, the absolute gap cover provides its clients with the internal prosthesis sub-limit benefit (up to R40,000 per event), the oncology co-payment benefit, and the oncology extender benefit. Moreover, each insured individual may anticipate receiving R20,000 in annual benefits for treatment at a hospital’s casualty unit.

Pricing and Discounts of Auto & General Medical Gap Cover Products

Auto & General Medical Gap Cover provides a variety of plans with different pricing options to meet the needs and budgets of various types of customers. The essential gap cover charges R99 and R360 for individuals younger than 65 and individuals older than 65, respectively. Also, the comprehensive gap cover charges R280 and R470 for individuals younger than 65 and individuals older than 65, respectively. And lastly, the absolute gap cover charges R450 and R630 for individuals younger than 65 and individuals older than 65, respectively. It’s important to note that Auto & General does not offer exclusive discounts on its medical gap cover insurance products.

Where Auto & General Medical Gap Cover Can Improve

Auto & General Insurance may consider enhancing the benefits offered in the essential gap cover and comprehensive gap covers. Auto & General insurance may also offer enticing price cuts to loyal consumers. The lack of such reductions for returning customers shows that new and returning customers are paying the same price.

How to Request a Quote for Auto & General Medical Gap Cover

If you’re interested in obtaining a quote for a medical gap cover plan, several options are available.

Click on the “Apply Now” button at the bottom of the homepage.

Fill out the application and choose a plan from the options for the coverage you need at an affordable price for your budget.

Alternatively, you can inquire by calling 0861 600 124.

Additionally, you can request a free quote. After submitting your information, a representative from the company will contact you by phone to discuss your quote further.

Frequently Asked Questions (FAQ)

What is the waiting period for a cancer diagnosis?

If the insured is diagnosed with cancer before membership, the time between making a claim and obtaining a response will be nine months.

Why is my claim for a pre-existing medical condition(s) denied?

Any claims made during the first six months of membership that involve a pre-existing sickness or conditions that might result in hospitalisation will be denied. During this time, insurers retain the right to seek medical data from policyholders if a claim shows or is connected to a previous condition. Any claims for specific disorders submitted during the waiting period will be reviewed by medical management to establish whether or not the patient has a pre-existing condition.

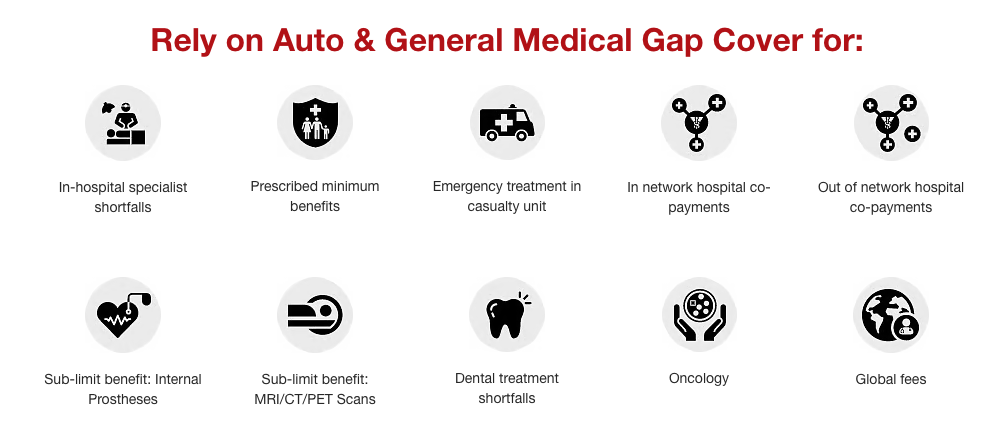

What is covered in the Auto & General medical gap cover?

The following coverage gaps are filled by Auto & General’s medical gap coverage:

In-hospital procedure shortfalls

Prescribed minimum benefits

Emergency medical treatment in the casualty unit

In-network hospital co-payments

Out-of-network hospital co-payments

Charges above sub-limits

Dental treatment shortfalls

Oncology

Global fees

Other Dial Direct Product Reviews

Comments

No Spam, "drip-feed" or other BS email!

Get an email from us only when we can provide insights or offers.