Auto § General Insurance Review

Auto & General Insurance at a Glance

- Innovative approach to meeting customer needs.

- Dedicated to providing value.

- One of the Top Companies by Financial Mail.

What we like:

Auto & General Insurance is committed to providing excellent service by leveraging technology. Customers can rely on its app for everything from mobile crash detection and emergency medical assistance to viewing policy details.

Best for:

South African consumers who wish to get comprehensive insurance products that can easily be accessed on their mobile devices can opt for auto & general insurance products.

- Excellent customer service and a simple claims procedure.

- Wide range of insurance products.

- User-friendly mobile app with multiple functionalities.

- Coverage is restricted to South Africa and select countries.

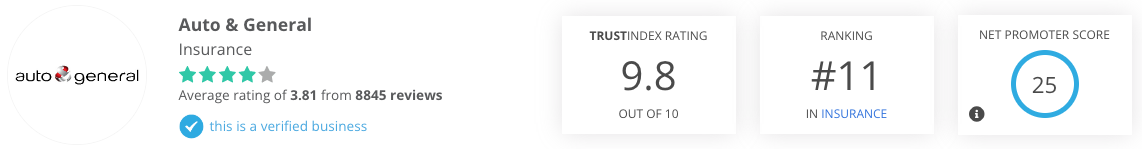

Reviews provided by Hellopeter

Auto & General Insurance is an award-winning insurance company that has made a reputation for itself throughout the globe by offering insurance services to over 11 million individuals in over eight countries. The company has gained South Africans’ trust as the go-to insurance provider for over three decades.

As a reputable financial services company, Auto & General Insurance prioritizes the act of creating innovative ways to adapt to the changing demands of its customers. The company has developed strong ties with a diverse variety of big and small brokers who are critical to the company’s financial success in the future.

Auto & General Insurance is committed to providing excellent service, making it a renowned entity in the South African insurance industry. So, this review will explore all the essential information about Auto & General Insurance, including its various product offerings and major pros and cons.

Auto & General Insurance Products

Auto & General offers its customers a broad choice of insurance products, including vehicle, home, and personal, value-added products, life, business, and pet insurance.

Vehicle Insurance

Auto & General provides a comprehensive range of vehicle insurance products, including car insurance, motorcycle insurance, caravan insurance, trailer insurance, watercraft insurance, off-road adventure insurance, and golf cart insurance. The company’s diverse product offerings are inspired by the different demands that customers may have for vehicle insurance. For example, caravan insurance protects your caravan and the items in it in the case of theft, loss, or accidental damage. Similarly, the Watercraft Insurance policy covers any theft, loss, or damage, so even if the waves are rough, you can be confident in your chosen watercraft. Another essential product that vehicle insurance offers is off-road Adventure, specifically designed to meet the specific demands of off-road vehicles. This policy is comprehensive; thus, you can be certain that your expensive automobile is protected.

Home and Personal Insurance

Auto & General’s suite of home and personal insurance products protects almost anything you could need, from your valuables to the buildings that house them to your funeral costs and mobile phone. Auto & General home and personal insurance policies are designed to protect your assets.

Auto & General offers various insurances to homeowners and renters, including home contents insurance, building insurance, and portable possessions insurance. Auto & General Home Contents Insurance protects policyholders against theft, loss, and damage caused by power surges caused by load shedding. Building insurance products from Auto & General may protect your home’s structure in the case of a fire or natural catastrophe, but they do not cover your personal possessions. The relevance of these products is to protect homeowners from eventualities that will result in an undesirable financial hit. In addition to home contents insurance, Auto & General also provides insurance to cover the structure of your house. Portable Possessions Cover is designed to cover portable assets like smartphones in the event of theft, loss, or other undesirable eventualities.

Value-Added Products Insurance

Auto & General Insurance customers may purchase a variety of value-added products as stand-alone choices or in addition to their core insurance coverage. These value-added products protect policyholders and their loved ones against common and rare eventualities.

For value-added products at Auto & General Insurance, the options include auto top-up, scratch & dent, pre-owned vehicle warranty, tyre & rim guard, legal cover, funeral plan, personal accident, extended vehicle warranty, and medical gap cover. Medical gap insurance was developed to assist with the out-of-pocket expenses associated with unexpected hospitalisation. Even if you have medical insurance, you may have to pay certain fees out of pocket, such as those charged by hospitals and specialists, even if your premiums and deductibles have been met. Medical gap insurance can help when medical expenses outstrip your policy’s payout.

Life Insurance

The life insurance cover from Auto & General Insurance serves to secure the upkeep of the policyholder’s beneficiaries in the event of their demise. Another advantage of having auto & general life insurance is that it protects against catastrophic diseases and losses due to disability. If a policyholder or their loved one is ever exposed to HIV, they benefit from the Expo-Sure service, which is included in all of Auto & General Insurance’s life insurance products.

Disability insurance pays out benefits for policyholders and their loved ones in the event of a debilitating sickness or trauma that renders the policyholder incapable of doing their normal jobs. Auto & General Disability Insurance will pay you a lump sum if you cannot perform within the scope of your employment due to sickness or an accident. The complete life insurance package also includes Pure Life Cover, Dread Disease Cover, Life Plans, Life Insurance for Those Over 65, and Terminal Illness Cover.

Business Insurance

Auto & general business insurance protects your business from financial devastation. Damaged equipment, a public liability suit, and a broken automobile are covered. Auto & General business insurance might be the key to safeguarding your company’s bottom line. Errors, accidents, and other types of risk might cost your company a lot of money—possibly more than it can afford. If anything like this happens, your business may incur significant financial losses. Depending on the nature of your business, you can get commercial insurance, specialised liability insurance, small business insurance, commercial vehicle cover, heavy commercial vehicle insurance, or corporate insurance.

The company offers business insurance that can be customised to meet the needs of over 700 different types of businesses. Specialist Liability Insurance will cover you if you ever have to defend yourself in court due to something related to your business. Small Business Insurance is designed to provide you with the same insurance protection you require without limiting your coverage. Commercial vehicle insurance and heavy commercial vehicle insurance are designed to protect you and your belongings from the specific hazards that your vehicle may encounter on the road.

Pet Insurance

Auto & General Pet Insurance provides comprehensive protection for pets. They provide three options from which you can choose the one that best suits your demands and budget. The service guarantee ensures that the provider will follow your chosen plan. Pet insurance coverage is classified into three types: emergency plan, core plan, and premium plan.

MiWay Headquarter and contact information

- HQ Address: Auto & General Park, 1 Telesure Lane, Riverglen, Dainfern, 2191

- Customer Support Phone: 0860 10 90 59

- Support Email: [email protected]

Frequently Asked Questions (FAQ)

How long before I get my payout after claiming?

The timing of your business insurance claim payout depends on you quickly providing the company with all of the documentation and information they need to assess and investigate your claim. Once all the required documents are submitted, the company pays out within two business days if the claim is successful.

How do claims on pet insurance work for Auto & General?

Pre-authorization is required for all hospitalization-related claims for your pets. Outside of regular business hours, pre-authorization requests may be submitted at 0861 07 77 00 or [email protected] to register a claim.

What is a Terminal Illness Cover?

Terminal illness cover is often incorporated as an added benefit in ordinary life insurance policies rather than being marketed as a separate policy. If you are diagnosed with a terminal disease with a life expectancy of fewer than 12 months during the course of your insurance cover, you may be entitled to the full amount of your insurance.

What is the Business Assist?

The Auto & General Insurance Business Assist benefit was designed to help businesses of all sizes. With BusinessAssist, you may connect with a network of specialists in major business areas, including consultants, mentors, and academics.

Other Auto & General Insurance Product Reviews

Comments

No Spam, "drip-feed" or other BS email!

Get an email from us only when we can provide insights or offers.