Auto & General Funeral Cover Review

Auto & General Funeral Cover at a Glance

- Good range of funeral cover options.

- High customer satisfaction rating.

- Hassle-free application through App or website.

What we like:

The Auto & General Funeral Coverage not only caters to the main member, but it also covers the funeral expenses of their spouse and dependent children, depending on the chosen coverage. Customers also enjoy the repatriation services offered by Auto & General Insurance at no additional cost.

Best for:

This insurance cover is best for South Africans between the ages of 18 and 65 who want a policy with pricing options that can fit any budget.

- Policyholders may choose the pricing structure that best fits their budget.

- Funeral coverage extends to deaths due to an HIV- or AIDS-related disease.

- Expedited claims processing and repatriation service.

- No unique bonus offering for recurring funeral insurance customers.

As one gets older, the benefit of having insurance increases. After graduating college and starting a new career, a young, unmarried individual is unlikely to consider purchasing a funeral cover. Yet, if you are your family’s main source of livelihood or have a family of your own, including a spouse and children, you should consider getting a funeral cover. This is because death is the most dreaded of all the terrible things in life. Even the healthiest among us may die, and the expenses of doing the funeral may surpass your financial means. Records have shown that South Africa is the fourth most costly nation for funeral arrangements. So there is a strong probability that the funds you have set aside will not be sufficient to cover everything needed to organise a successful funeral.

Therefore, getting funeral cover is one way to guarantee that your funeral expenses do not financially burden your loved ones. Your loved ones will not have to go into their funds to meet your funeral expenditures after your death since the money from your funeral plan will cover those costs instead. Funeral cover insurance often covers at least part of the costs of a funeral and, in some situations, all of them. Burial or cremation charges, flower arrangements, travel expenses, food, and other necessities are all covered in the funeral cover.

Auto & General Insurance is a company that offers funeral coverage in South Africa. And in this review, we will provide a detailed overview of Auto & General Funeral Cover, highlighting the service’s key features and the benefits and drawbacks of enrolling in the insurance product.

What Makes Auto & General Funeral Cover Different?

Funeral cover insurance from Auto & General will pay for your funeral expenditures in the event of a policyholder’s death, the death of their spouse, or the death of any of their dependent children. Repatriation services are also provided to policyholders, putting the burial plans in the hands of the insured’s loved ones rather than a third party. After that, the deceased’s corpse will be transferred to the portion of the selected funeral home that is closest to the burial place. Yet, for this repatriation service to be provided, both the death and the burial must have happened inside South Africa.

Auto & General Funeral Cover - Coverage Options and Benefits

Auto & General Funeral Cover will give a policyholder’s loved ones the funds they need to carry out your predetermined funeral arrangements. Also, this funeral cover insurance policy will pay for the funerals of the policyholder, their spouse, and their dependent children. Policyholders can also benefit from the repatriation services offered by Auto & General Insurance.

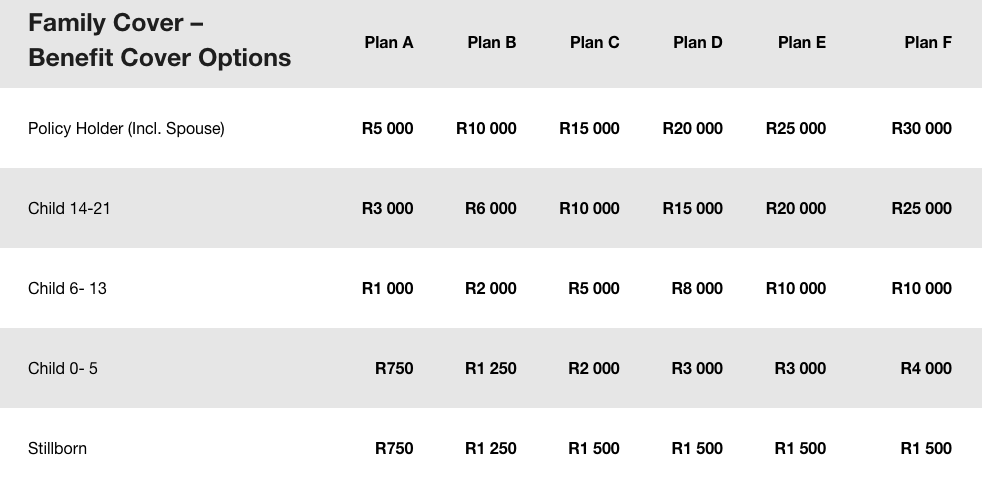

Anyone between the ages of 18 and 65 may get Auto & General funeral cover. The options for funeral cover insurance vary from coverage for only the primary member to coverage for the primary member, their spouse, and up to five minor children under the age of 21. Coverage for extra dependents is available for an additional charge.

Pricing and Discounts of Auto & General Funeral Cover

Auto & General Funeral Cover offers six pricing plans, from Plan A to Plan F. The pricing ranges from R5,000 to R30,000. It provides premium services starting at R26pm. But there are currently no exclusive discounts offered to loyal clients.

Where Auto & General Funeral Cover Can Improve

The maximum coverage available through Auto and General funeral cover is R30,000, much less than that available through funeral insurance in South Africa. The company may consider raising the amount of coverage provided to guarantee that all covered persons under each plan get sufficient payments to cover the cost of funeral expenditures.

How to Request a Quote for Auto & General Funeral Cover

A funeral cover plan quote may be obtained from several sources, and you can choose the one that works best for you.

One way is to visit Auto & General’s funeral cover page and click on the “Get a quote” section.

After completing the form, click the “submit” button for a quotation considering your specific choices.

Alternatively, you can inquire by calling 0861 60 01 24.

Moreover, on the “contact us” page, there is a section called “Get a Quote,” where you may fill in your name and phone number for a free quote. When you submit your information, a business representative will contact you to discuss your quotation further.

Frequently Asked Questions (FAQ)

What are the waiting periods?

The waiting period is when you cannot get insurance benefits, but you can continue making your monthly payments. The following are the waiting periods:

Following six months of monthly payments, the funeral cover will pay out in the case of a natural death.

The policyholder’s coverage from accidental death begins the day the firm receives your first premium.

If your previous coverage is still in force within 31 days of purchasing this policy, the appropriate waiting period is the rest of that waiting period. If there is no spare waiting time on your previous coverage after the waiting period, this insurance will take effect immediately. Waiting periods are only subject to change if you terminate your current coverage or notify the company of your intention to do so.

If you want your decreased waiting period to be recognised on this policy in the event of a claim, you must provide a copy of your most current policy schedule from your previous insurer for evaluation and confirmation. This will assist them in determining the integrity of your request for a lower wait time.

What is excluded from my cover?

Auto & General will not provide funeral coverage or pay benefits if the covered person dies as a direct or indirect result of or attributable to suicide or an attempt at suicide within the first 12 months following the policy’s effective date. This is true whether the suicide or attempted suicide was motivated by insanity, mental disease, drug use, or being drunk with the prospect of death.

What age is qualified for the funeral cover?

If you apply for funeral insurance between the ages of 18 and 65, you will be approved.

How do I claim?

A qualified adviser will assist you in filing a claim under the Funeral Cover insurance policy if you phone the company’s call centre at 0860 10 47 89 between 08:00 and 17:00 Monday through Friday and 8:00 and 13:00 Saturday.

Other Dial Direct Product Reviews

Comments

No Spam, "drip-feed" or other BS email!

Get an email from us only when we can provide insights or offers.