1st for Women Pet Insurance Review

1st for Women Pet Insurance at a Glance

- Three main pet insurance policies for any budget.

- No waiting period for accident claims.

- Numerous perks and discounts such as Vet@First.

What we like:

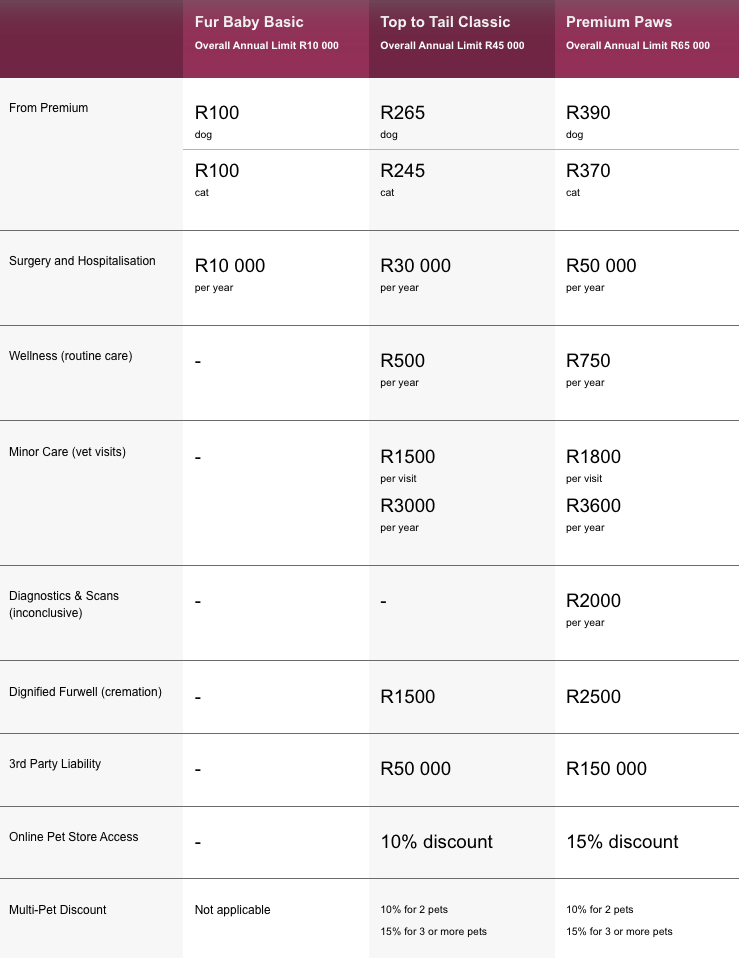

Pet insurance can seem like a luxury for many South Africans, but 1st for women’s basic coverage policies can suit smaller budgets. The ‘Top to Tail Classic’ policy is also fairly comprehensive for the price point, with ‘Premium Paws’ offering full comprehensive cover with higher payouts. There are opportunities to receive discounts, and there are no excess payments on Wellness, ‘Dignified Furwell’ and 3rd party liability claims.

Best for:

As mentioned, 1st for women’s pet insurance policies are tailored to suit different budgets. However, their policies are more suited to dog and cat owners with younger, healthier pets and no existing health conditions. It is also ideal if you own more than one pet and are tech-savvy so you can save on goodies via their designated pet store.

- Budget-friendly.

- Discounts if you have more than one pet.

- Access to 24-hour helpline Vet@First.

- The cover is limited to the type of pet and specific illnesses.

Your pet is a valuable, albeit furry, member of your household, so it makes sense that you’d want to keep them healthy and happy for as long as possible. There are many ways to do this:

choosing the best foods to keep their coats shiny and guts healthy, regular grooming appointments, and lots of fun toys!

But what happens when your pet falls sick unexpectedly? Pet insurance may seem like an unnecessary expense, but it is a great way to mitigate the costs that can come with having a furry family member. Luckily. 1st for women offers three pet insurance policies with tons of additional perks, so affording a pet can be easier than ever!

What Makes 1st for Women Pet Insurance Different?

1st for women has three pet insurance policies with varying coverage amounts to suit your budget and pets’ needs. Their policies also come with a number of additional perks which make them stand out as an insurer.

As part of their Guardian Angel Assistance programme, you’ll have access to Vet@First which is a round-the-clock emergency and healthcare line. This includes a trusted selection of animal experts who can give you medical and nutritional advice or guide you through the appropriate steps to take in an emergency. They can also refer you to local vets and animal clinics if your pet needs medical attention.

Uniquely, 1st for women offers a ‘Pet Taxi’ perk. This is pretty much like having a private chauffeur for your pet! They will ensure that your pet has a safe journey to their vet, pet hotel, or grooming parlour. This can be an especially useful perk if you lead a busy lifestyle but still want your pet to have the best!

Lastly, there are no excess payments for wellness, funeral and 3rd party liability claims. This is a great money-saving perk and makes the claims process less stressful.

1st for Women Pet Insurance Coverage Options and Benefits

Fur Baby Basic Insurance

This policy is ideal for those who just want the bare minimum coverage, have a lower budget, or have an older pet. The policy only covers surgery and hospitalisation costs for up to R10,000 annually. Unfortunately, there is also no multi-pet discount.

Top to Tail Classic Insurance

This policy has an overall annual limit of R45,000 and covers most pet-related health expenses. What does this cover? Surgery and hospitalisation costs are covered for up to R30,000 annually, with a separate R3,000 allocated for vet visits. There is also R500 allocated to routine care or wellness treatments each year. And third-party claims are covered for a whopping R50,000.

Unfortunately, this policy does not cover diagnostics and scans. But if the worst should happen, you’ll be given a lump sum of R1,500 under the ‘Dignified Furwell’ benefit to help you with cremation costs and a fitting farewell to your companion.

You also get access to the online pet store ‘OnePet’, with a 10% discount on goods. Another great way to save with this policy is by insuring multiple pets. There is a 10% discount for insuring 2 pets and a 15% discount for insuring 3 or more pets.

Premium Paws

This policy is ‘purfect’ for pet owners who are looking for fully comprehensive insurance packages. While the premiums might be higher, there is a bigger 15% discount on goods from the online pet store ‘OnePet’. The multi-pet discount of 10% for 2 pets and 15% for 3 or more pets still stands.

Surgery and hospitalisation costs are covered for up to R50,000 per year, while routine care is covered for R750 annually. The minor care benefit which covers vet visits is increased to R1,800 per visit and R3,600 annually. The ‘Dignified Furwell’ benefit is increased to R2,500. If your pet can be a bit badly behaved, don’t worry because this policy offers 3rd party liability to a maximum of R150,000! Also included are diagnostics and scans up to the value of R2,000 per year.

Pricing and Discounts of 1st for Women Pet Insurance

Premiums for the ‘Fur Baby Basic’ insurance policy start from R100 for both dogs and cats. The ‘Top to Tail Classic’ policy premiums start at R265 for dogs and R245 for cats. And the ‘Premium Paws’ policy can set you back a minimum of R390 per month for dogs, and R370 for cats.

Be aware that these are the minimum premium amounts, your premiums are generally calculated on the type of policy and risk factors like age, type of pet, and health conditions. The trend is that premiums for younger pets with no underlying health problems, as well as cats, are lower. One way to lower your premiums is by insuring two or more pets.

Where 1st for Women Pet Insurance Can Improve

Currently, 1st for women’s pet insurance only covers dogs and cats. This excludes many other fairly common types of pets like rabbits and birds. It is also unclear whether you can add the ‘Cash Back Plus’ programme to this policy, as it is not explicitly stated.

There are also a number of exclusions to their coverage. Some of these exclusions include all pre-existing conditions and diseases preventable by vaccines. This refers to diseases like distemper, rabies, and feline herpesvirus. Your cover also does not include congenital/hereditary conditions, elective procedures and diets, and obesity and behavioural conditions.

How to Request a Quote for 1st for Women Pet Insurance

- Enter your name and contact number on their website to receive a call and quote

- Call their customer service number on 0860 10 42 12 to get a quote from a consultant

Frequently Asked Questions (FAQ)

How do I make changes to my 1st for women's pet insurance policy?

Policy cancellations can be emailed to [email protected] or by phoning 0861 20 13 13. Any changes can also be made by phoning the customer service line on 0860 10 42 12. Notification of changes must be done one calendar month in advance.

Does the wellness benefit include grooming?

Yes! The wellness benefit includes deworming, tick and flea control, and nail clipping. Your pet is also covered for voluntary sterilisation, vaccinations, and anal gland expression under this benefit.

Other 1st for Women Product Reviews

Comments

No Spam, "drip-feed" or other BS email!

Get an email from us only when we can provide insights or offers.