Dial Direct Insurance Review

Dial Direct Insurance at a Glance

- Streamlined claims process.

- Offer a range of life and non-life insurance products.

- 24/7 emergency assistance services.

What we like:

Dial Direct expedites the insurance claims process, which means policyholders have lower risks of having to cover certain costs out-of-pocket before they receive a payout. The company's mobile app is also a versatile tool that combines multiple functionalities - including policy modification - in a single user-friendly platform. Dial Direct also gives 1GB of free data to new customers who sign up for its online platform.

Best for:

If you are looking for an insurance provider that offers well-appointed combo deals that meet the needs of most South African car owners, Dial Direct is an ideal option for you. The combo plans, also called bundled insurance products, help policyholders optimize benefits while mitigating cost.

- 24-hour emergency service.

- 1GB of free data sign-up bonus.

- Discounted offers and payback bonus.

- Premiums for policies like vehicle insurance increase with age.

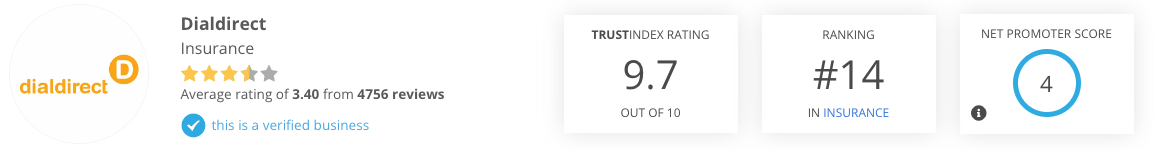

Reviews provided by Hellopeter

Dial Direct is a reputable insurance provider that has won prestigious accolades including the Top Reputation Winner in the 2021 Top Companies Reputation Index – Financial Services. The company set out 14 years ago to streamline the modality of purchasing insurance products in South Africa. A decade ago, prospective policyholders often couldn’t purchase insurance products on their own, and had no choice but to work with insurance intermediaries – also called insurance agents, insurance brokers, and insurance middlemen – when looking to purchase insurance products. This was a stressful and expensive process for some policyholders.

As an insurance provider that embraces technological innovation and all its benefits with respect to creating platforms that digitalize the insurance purchase process, Dial Direct boasts one of the most stress-free platforms for obtaining quality insurance products in South Africa. The company also has a mobile app that allows consumers to download insurance documents, make policy modifications, and track premiums.

In this review, we will provide an overview of Dial Direct’s range of insurance products and highlight the general benefits associated with each category. This will allow you to assess and compare Dial Direct’s insurance offerings with those of other providers in South Africa, allowing you to choose the product that aligns with your specific needs and preferences.

Why Choose Dial Direct Insurance?

Dial Direct offers South Africans convenient and hassle-free options for buying and customizing insurance products. If you’re searching for a reliable insurance company that provides 24/7 emergency assistance service with the majority of its products, Dial Direct is a great option. Additionally, Dial Direct has a fast-tracked claims processing system in place, which guarantees that claims for various personal and household items will be paid on the same day, provided a policyholder submits the necessary claim documents on time.

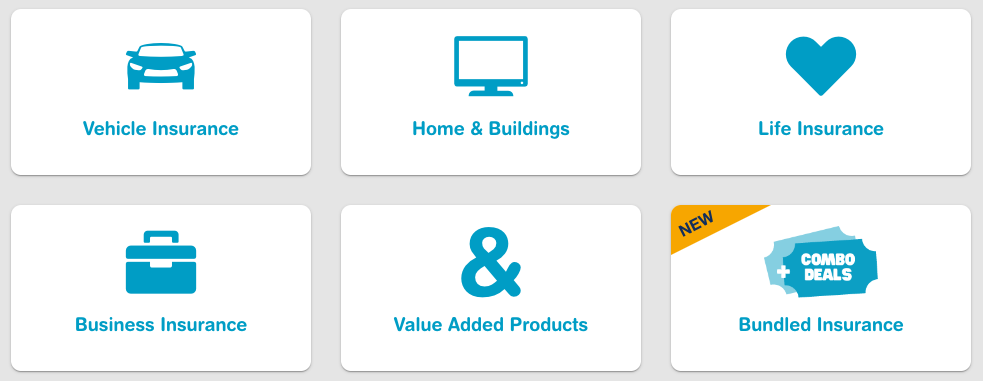

Dial Direct Insurance Products

Dial Direct offers a wide range of insurance products. These include:

Vehicle Insurance

One of Dial Direct’s prominent offerings is vehicle insurance, which is a portfolio of specialized products that cover cars, motorbikes, caravans, watercraft, trailers, and golf carts. Their comprehensive car cover provides policyholders with a multitude of options, such as Dial Direct Monthly Payback, where a policyholder can earn up to 75% of their premium back in cash every month for driving responsibly and insuring correctly. Additionally, Dial Direct’s vehicle insurance policyholders can manage their policies conveniently through a free personal online profile that allows them to inspect their vehicles 24/7.

Home and Buildings Insurance

Dial Direct Home and Buildings Insurance offers three types of coverage: home contents insurance, buildings insurance, and portable possessions insurance. With Dial Direct Comprehensive Home Cover, your valuables are protected against break-ins, theft, fire, lightning, and power surges. The Buildings Cover protects various parts of your home’s structure, including garages, outbuildings, windows, swimming pools, domestic accommodation, gates, and walls. Portable possessions insurance covers valuable items that you often take with you, such as smartphones, earphones, laptops, child car seats, and sunglasses.

Life Insurance

Dial Direct provides a range of life insurance options to ensure that policyholders and their loved ones are protected in various scenarios. Its life insurance products include Pure Life Insurance, Dread Disease Insurance, and Disability Insurance. Pure Life Insurance offers coverage ranging from R50,000 to R10 million based on a policyholder’s lifestyle and dependents. Dread Disease Insurance covers policyholders for their lifetimes in the event of a diagnosis of a serious illness. Disability insurance pays out between R50,000 and R10 million to policyholders who experience conditions that impair their ability to earn a living using their preexisting vocational skills before the injury.

Business Insurance

Dial Direct offers a comprehensive range of specialized business insurance products to cover various types of businesses operating in South Africa, ranging from tradesmen to specialized professional businesses like engineering and management consulting. Additionally, they provide professional indemnity insurance that protects policyholders in case of professional errors, which may result in financial losses for their clients. This coverage indemnifies the policyholder’s clients for the financial loss caused by a professional mistake, such as negligent advice.

Dial Direct Value Added Insurance

Dial Direct offers a range of value-added insurance products that are not intended to provide complete protection but rather to enhance the benefits of other insurance products. These specialized products serve as add-ons to existing policies and are designed to provide additional coverage for specific risks. For example, scratch and dent cover can be purchased by policyholders whose vehicles are susceptible to minor damages. Although this product alone cannot protect the vehicle from theft and other risks, it can help ensure that the vehicle’s exterior remains spotless. Other value-added products offered by Dial Direct include pothole insurance, personal accident insurance, legal cover, funeral cover, an extended vehicle warranty, and a pre-owned vehicle warranty.

Dial Direct Bundle Insurance

Dial Direct offers bundle insurance packages that allow customers to choose combo deals. Dial Direct 2-in-1 Happy Deal Combo provides car insurance with non-comprehensive theft and write-off coverage, third party cover up to R1 million, hail cover, and towing, along with pothole insurance that covers damage to tyres and rims. The 3-in-1 StreetSmart Combo adds cellphone insurance to the package.

MiWay Headquarter and Contact Information

- HQ Address: 1 Telesure Lane, Riverglen Fourways, Gauteng, 2191 South Africa.

- Customer Support Phone: 086 155 5598

- Email: [email protected]

Frequently Asked Questions (FAQ)

Why is a vehicle inspection necessary?

Dial Direct conducts free car inspections to verify its existence and document any present damage, including accessories, which helps expedite the claim process. However, they don’t inspect vehicles insured for third-party use only, except when the client has chosen sound equipment coverage worth R5,000 or more.

When my vehicle is damaged in an accident, can I have it repaired at the panel beater of my choice?

The company’s policy requires that they use a supplier from their approved list of motor body repairers to fix a customer’s vehicle. These repairers offer a lifetime guarantee on their work and allow the company to monitor the quality of the repairs provided. If a customer insists on using a different panel beater, Dial Direct will provide a cash settlement equivalent to the cost of the repair, but they cannot guarantee the quality of the work done by the chosen panel beater.

What is a Payback Bonus and when does it pay out?

If you have comprehensive vehicle cover with Dial Direct Payback or a home contents and buildings policy, you will receive a Payback Bonus. This bonus entitles you to a cash payout of up to 25% of all premiums paid, or the entire first year’s premiums (whichever is less), after maintaining continuous cover with Dial Direct for four consecutive years. The payout is made regardless of whether you have made certain claims during this period.

What do I need to do to cancel my policy?

With a Dial Direct insurance plan, you have the option to cancel your policy without any prior notice. However, you also have the option of providing notice of cancellation for a future date. To cancel your policy, you can do so over the phone, and the cancellation will be confirmed in writing.

Other Dial Direct Product Reviews

Comments

No Spam, "drip-feed" or other BS email!

Get an email from us only when we can provide insights or offers.