King Price Insurance Review

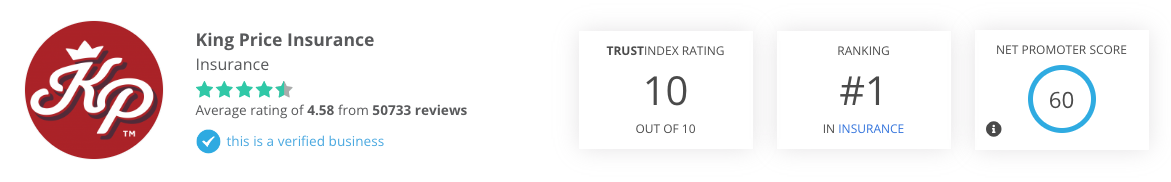

King Price Insurance at a Glance

- Offers cost-saving and flexible insurance products.

- Unique insurance solutions tailored to serve South Africans optimally.

- Matching premium costs with the value of the protected asset.

What we like:

King Price is an insurance provider that can provide you with personalized quotes that match your unique risk profile. Their services are tailored to meet your specific needs, so you can be sure that you're getting the right level of coverage. Additionally, they offer discounts on policy expansion and up to a 30% premium rebate for underused services in select business packages.

Best for:

Cost-savvy insurance products and custom-tailored additional benefits.

- Transparent and reasonable quotations.

- Strong commitment to customer satisfaction and multiple contact options - including email, phone, and social media.

- King Price insurance coverage is restricted to a select few African countries.

- Additional excess may be charged outside of South Africa.

Reviews provided by Hellopeter

Introducing King Price, a South African-based insurance company that sets out as a provider of short-term insurance products with unbeatable value. The company eventually acquired Stangen and began to offer life insurance products, which makes it a provider of both short-term and long-term insurance. Their policies cover everything from cars and households to buildings and specialized items, ensuring full protection for clients against life’s unexpected events. King Price Insurance aims to revolutionize the insurance industry by providing affordable policies that offer true value to their clients. The company believes that everyone should have access to quality insurance, regardless of their financial situation.

King Price’s exceptional service and affordability have earned them recognition, winning over 20 different awards since their launch in 2012, including the prestigious South African service awards.

In this review, you’ll gain insight into the nuances of King Price Insurance’s products as well as a comprehensive list of the advantages and disadvantages of their offerings.

Why Choose King Price Insurance

King Price Insurance offers short-term insurance products that prioritize consumerism, providing coverage without sacrificing budget. The company offers some of the lowest premiums in the industry, along with generous discounts that increase as clients expand their coverage. Unlike other insurance companies, King Price Insurance ensures that the cost of premiums reflects the actual value of clients’ assets, avoiding overpayment for unnecessary coverage. King Price Insurance is a trusted and reputable choice for savvy consumers in South Africa.

King Price Insurance Products

King Price provides a comprehensive range of personal insurance products, including car insurance, building insurance, home contents insurance, and personal possessions coverage.

Car Insurance

King Price offers six different types of car insurance products, providing customers with the freedom to select the product or combination of products that best aligns with their unique requirements. These include comprehensive cover, theft and write-off cover, third-party cover, and agreed value cover. Innovatively, King Price’s car insurance products are designed to decrease monthly premiums in line with the depreciating value of the insured vehicle. This approach contrasts with traditional insurance products that only increase premiums over time.

Home Insurance

Building Insurance

King Price offers comprehensive building insurance that covers all physical structures on your property, including your home, outbuildings, water pipes, geysers, fixed glass, and sanitary ware. The company provides coverage against insured perils and accidental damage, as well as fire brigade callouts.

Home Contents Insurance

King Price offers comprehensive home contents insurance that provides coverage for all of your personal belongings, including your favourite TV, tablet, clothing, bedding, antique furniture, and any other items that you wish to protect. Policy options are flexible and can be customized to suit your individual needs, allowing you to choose the coverage that best suits your situation.

Portable Possessions Insurance

King Price’s personal portable possessions insurance covers the repair or replacement of stolen or damaged belongings, such as cameras, tablets, clothing, travel luggage, and jewellery, regardless of where the incident occurred. Whether you’re out and about in town or travelling the world, if something happens to your valuables, you don’t have to worry.

King Price Life Insurance

King Price life insurance products include life cover, funeral cover, disability cover, critical illness cover, and salary protection. Another unique product called Commuter Cover is a category of King Price Life. The product offers coverage to pedestrians, non-professional drivers, and passengers who died or face disability due to commuting-related accidents.

Other King Price Insurance Products

King Price Community Insurance

King Price community scheme insurance offers a full spectrum of protection for assets in residential communities. These products cover infrastructure and assets like electronic equipment, machinery, building and common area contents, vehicles, and geysers. The comprehensive community insurance products also cover office bearer’s liability, public liability, employer’s liability, personal accidents of voluntary workers, and claims preparation costs. The overarching insurance products also feature additional benefits, such as home modifications, flood resilience and protection, damage from power surges, the cost of alternative accommodations, and medical costs, among others.

King Price Agri Insurance

King Price offers a diverse range of unique agribusiness insurance plans that provide customers with a high level of options. The specialized products cover a range of areas, including accidental damage, building coverage, cybersecurity, electronic equipment, and business risks. Customers can tailor their coverage to their high-priority protections or purchase more specialized coverage, such as for goods in transit, fire damage, livestock and game, irrigation systems, and machinery breakdown.

The company has a unique approach to premium costs that prioritize matching the cost to the level of protection that South African farmers receive. This is achieved through the use of trackers and specialized computer systems that monitor farm activities and operations. For example, King Price’s “pay as you farm” system tracks when vehicles are in use and when they are not. The system provides immediate benefits by allowing farmers to make real-time decisions based on this information. In addition, farmers may receive an annual rebate of up to 30% of their premium, which provides long-term benefits.

King Price Business Insurance

King Price business insurance provides coverage options for businesses to protect their assets and operations. The company offers a range of products specifically tailored to meet the needs of various industries, including franchises, manufacturers, and the healthcare sector. These products cover a variety of risks, such as business all-risk, accidental damage, accounts receivable, electronic equipment, business interruption, and goods in transit, among others.

In addition to these coverage options, King Price’s comprehensive business insurance also includes a fidelity insurance package, which is crucial coverage for businesses. Fidelity coverage, also known as crime insurance, is a type of business insurance that protects against financial losses resulting from fraudulent or criminal acts committed by employees or third-party individuals.

With King Price’s fidelity coverage, businesses can protect themselves against financial losses resulting from dishonesty, fraud, or theft of money or any other asset by an employee. This coverage can provide businesses with peace of mind, knowing that they have protection in place against potential financial devastation caused by fraudulent activities.

MiWay Headquarter and contact information

- HQ Address:

Menlyn Corporate Park, Block A

Corner of Garsfontein Road & Corobay Avenue, Waterkloof Glen, X11, 0181 Phone support: 0860 50 50 50

Email: [email protected]

Website: https://www.miway.co.za

Frequently Asked Questions (FAQ)

Am I insured anywhere else in Africa?

If you have a policy with King Price, you can enjoy coverage not only in South Africa but also in several neighbouring countries, including Botswana, Lesotho, Mozambique, Malawi, Namibia, Swaziland, and Zimbabwe. It’s important to note, however, that this coverage applies only for private use, and if you experience an incident while outside of South Africa, an additional excess may be charged.

What is excess?

As a policyholder, it is your responsibility to pay an excess amount, which is the initial portion of a claim that needs to be paid. King Price, like most other insurance companies, requires policyholders to pay a basic excess amount when filing a claim.

There may also be situations, as outlined in your policy schedule, where you will be required to pay an additional excess amount based on the level of risk associated with your policy. While it may appear to be an extra expense, the excess amount you pay is relatively minor when compared to the risk undertaken by the insurer on your behalf. By paying the excess, policyholders can benefit from extensive coverage and peace of mind, knowing that they are financially protected in case of unforeseen events.

How will my claim be settled?

If you have a valid insurance claim with King Price, you have three options for compensation. You can receive a cash payment, have the damage repaired at a repairer chosen by King Price, or have the insured item replaced with a new one from a supplier approved by King Price.

It’s important to keep in mind that if the item you’re claiming for is financed, King Price will pay the finance company first before paying you.

How can I keep my premium as low as possible?

To have an impact on your insurance premium and annual increase with King Price, there are several measures that you can take. You should always provide truthful and accurate information about your personal details and claim history. By insuring all your valuable items under one policy, you can receive up to 20% off when insuring two or more cars with King Price. You should also:

Install an alarm in your home or business to reduce your risk profile for home and business insurance.

Pack your car in a locked garage instead of on the street to lower your car insurance premium.

Maintain a good credit score to minimize your risk profile

Other King Price Product Reviews

Comments

No Spam, "drip-feed" or other BS email!

Get an email from us only when we can provide insights or offers.