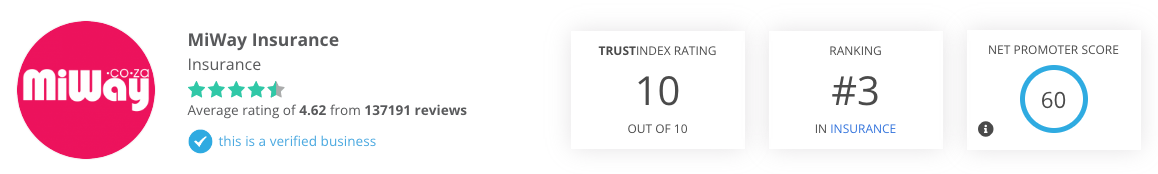

MiWay Insurance Review

MiWay Insurance at a Glance

- A seamless way to purchase insurance online.

- Get 1 months premium back after 3 months.

What we like:

MiWay provides a user-friendly online platform for customers to easily buy insurance products. By sharing their personal information via the current policy schedule, customers can request and receive competitive insurance quotes generated by MiWay so they can compare quotes with other providers. Customers can also choose and purchase a personalized combination of products and enjoy discounts for product combinations.

Best for:

Flexible car insurance products and scalable business insurance packages.

- Wide range of insurance products: MiWay sells four major types of insurance products, which are car, home, building, and business insurance. Customers can choose the coverage that meets their individual needs and budget.

- Easy to comprehend policies: MiWay provides policies that are straightforward and easy to understand, without any complicated fine print, making it easy for customers to know what they're covered for.

- Incentives for online customers: MiWay offers incentives to customers who apply for and take out insurance policies online, including a free full month's premium payable after three months of full premiums. This provides an extra incentive for customers to use the online service, which saves them time and effort.

- Restricted to Non-Life Insurance Products: MiWay does not provide life insurance products, which means its portfolio of packages is not overarching. Customers who require life insurance products may purchase life insurance policies from other providers.

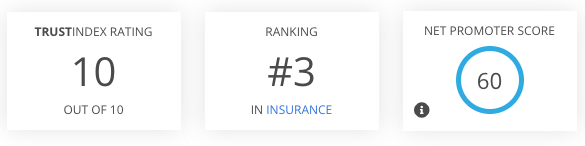

Reviews provided by Hellopeter

About MiWay Insurance

MiWay is a licensed non-life insurance provider and financial services provider that offers a wide range of insurance products to customers, such as car, home, building, business insurance, and liability cover. Its major shareholder, Santam, is a reputable JSE-listed firm that provides financial stability and credibility to help establish MiWay’s unique brand identity.

Dedicated to providing excellent service, MiWay offers customers the flexibility to choose the insurance coverage that suits their needs and budget, with policies that are easy to comprehend without any complicated fine print. Customers have the option to interact with MiWay through their call centre or online, 24/7/365, to give feedback or make other requests. The company provides a stress-free and efficient claims process, along with flexible asset protection options.

MiWay’s goal is to empower South African consumers by offering them the convenience of managing their financial services and buying insurance online. As the first online-enabled non-life insurer in South Africa, the company provides a complete online quoting, buying, and policy management service. With terms and conditions, MiWay also incentivizes customers to apply for and take out insurance policies online, including a free full month’s premium, which is approved after three months of full premiums.

MiWay Insurance Products

MiWay's Home Contents Insurance

MiWay’s Home Contents Insurance, MiHomeStuff, provides coverage against fire, theft, water, wind, and storm damage for household belongings. The policy is connected to affordable premiums with a low flat excess, a hassle-free claims process, free Household Emergency Assistance, and alternative accommodation in case of an unfit building. Customers can also opt for additional coverage options such as extended theft cover, cover for loss due to power surges and dips, and extended coverage for garden and leisure equipment.

MiWay's Building Insurance

MiWay’s Buildings Insurance, MiPlace, covers permanent structures and fixtures on a property, including borehole and swimming pool pumps, and underground pipes and cables. The policy covers damages caused by fire, damaged gate motor or pool pump due to a lightning strike, water damage, loss or damage caused by permanent water supply installations, and loss or damage of a thatch roof property with a SABS-approved lightning conductor.

MiWay’s affordable premiums come with a low flat excess and the option to fix premiums for 36 months. By applying online, customers can receive an average full month’s premium after three months of full premiums. The policy includes free Household Emergency Assistance and alternative accommodation in case of an unfit building. The company’s award-winning customer service provides a seamless claims process, with the option to manage the process online.

MiWay Car Insurance

MiWay offers affordable and comprehensive car insurance in South Africa with an easy claims process, 24-hour roadside assistance, and WeDrive service. Customers can choose from different types of car insurance, which are Comprehensive, Third-Party, Fire and Theft, Third-Party Only, and Total Loss.

Comprehensive insurance provides coverage for a wide range of situations, including damage caused by accidents, explosions, fires, natural disasters, as well as loss due to theft, hijacking, and intentional damage to your vehicle. Comprehensive cover typically involves a high premium.

Third Party, Fire and Theft insurance covers damage caused by other people during an accident, as well as fire-related damage and theft. However, it does not cover damage to your own vehicle caused by an accident.

Third party only insurance provides coverage for damage or loss to other people’s vehicles in the event of an accident, but does not cover any damage to your own vehicle.

Total Loss insurance policy specifically covers instances where your vehicle is completely lost due to theft, write-offs, or hijacking. However, this policy only provides limited coverage for third-party liability, and any accidental damage that falls short of being a total loss is not included in this insurance coverage.

MiWay’s car insurance also features a unique take-me-home driver service called WeDrive. Premiums are dependent on risk profile and increase annually.

MiWay's Business Insurance

Through its proprietary business insurance product, MiWay implements scalable solutions to support business growth. Clients can potentially pay less for insurance if their business vehicles travel less. The company provides the option of a fixed standard excess or a percentage excess to fit clients’ financial needs. Clients can also benefit from emergency roadside assistance, and coverage for lock and key replacement. Additional services include wreckage removal, towing limits, and storage of business vehicles.

MiWay’s business insurance coverage extends beyond South Africa to other African territories. Policyholders can also receive a replacement vehicle while theirs is being repaired, and access MiBusinessAssist for marketing, legal, financial, and labour support to help keep their businesses running smoothly.

MiWay Headquarter and Contact Information

- HQ Address: 48 Sterling Road, Samrand Business Park, Kosmosdal Ext 12, Centurion, 0157

- Phone support: 0860 64 64 64

- Email: [email protected]

- Website: https://www.miway.co.za

Frequently Asked Questions (FAQ)

How many car insurance claims can you make in a year?

If a client makes frequent claims that make them too risky to insure, an insurer can terminate their coverage. The insurer must inform the client of this decision, which is known as “cancellation of contract due to multiple claims”. It’s important to read and review any documents or correspondence from the insurance company to ensure you’re aware of this situation.

Why is it important to specify the driver of the insured car?

To insure a car, the person who drives it most within 30 days must be identified as the “regular driver” in the contract. If this driver changes or is recorded incorrectly, a claim may not be paid out, and the policy could be cancelled. Nonetheless, MiWay gives permission for anyone to drive the car as long as they don’t drive it more than the specified regular driver, as the premium is based on the risk profile of the regular driver.

Why was my car insurance policy cancelled after claiming?

It’s essential to be truthful when setting up your insurance policy and filing claims. Non-disclosure, or failure to disclose information or being dishonest, can result in claim denial and contract termination. For example, falsely claiming that a family member is the regular driver to get a lower premium is an example of non-disclosure. Insurance companies cancel policies rarely, but it’s sometimes necessary to curb fraudulent activities.

Other MiWay Product Reviews

Comments

No Spam, "drip-feed" or other BS email!

Get an email from us only when we can provide insights or offers.