Budget Insurance Review

Budget Insurance at a Glance

- Budget Insurance was founded in 1998.

- Offers a variety of insurance.

- Budget Insurance currently operates in four countries.

What we like:

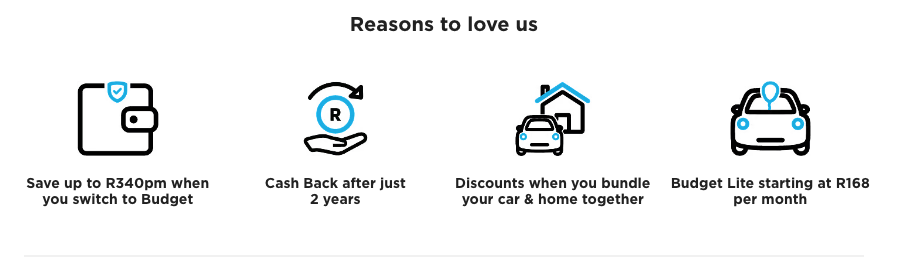

Budget insurance caters to the South African insurance market by offering multiple policies designed to suit different lifestyles. Whether you're looking for the bare minimum coverage or you don't have enough cash monthly for full comprehensive cover, Budget Insurance aims to give you peace of mind and financial assistance in your times of need. The additional benefits and cash back programme are great incentives and allow you to find a policy that suits your needs.

Best for:

Budget Insurance policies are best suited to people who are looking to get the most bang for their buck. There are many financial incentives to switching to Budget Insurance, however, their plans can be enticing alone. Many of their plans are fairly comprehensive despite their names. For example, their ‘Fire and Storm Only Insurance’ covers much more than simply fires and storms.

- Tailored and comprehensive insurance policies.

- Opportunities for discounts and cash-back.

- Premiums suit smaller budgets.

- There are many contact numbers which can quickly become confusing.

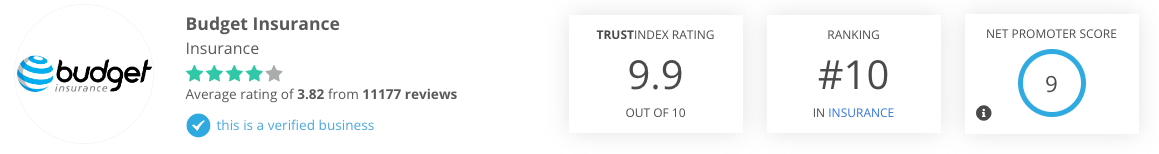

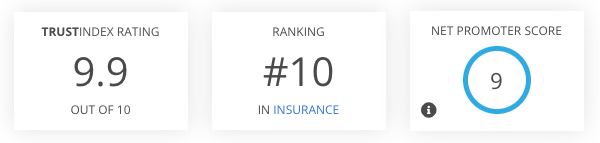

Reviews provided by Hellopeter

With 25 years in the insurance business, Budget Insurance’s niche is providing affordable car, home, and business insurance. The company itself is a subsidiary of Telesure Investment Holdings which also owns companies like 1st for women and 1Life.

Budget Insurance offers a range of basic and comprehensive insurance packages because insurance should never be out of the budget! There are also many additional cover options, allowing you to tailor your policy to your needs.

Staying true to their name and promise to help you save, Budget Insurance offers an extensive Cash Back Bonus programme and lower premiums if you bundle policies. Currently, if you switch your car and home policies to Budget Insurance you can save up to R420 per month. And while their premiums may be cheap, the service is still top-notch with a comprehensive assistance programme and 24/7 business assistance.

Budget Insurance Products

Car Insurance

When it comes to choosing a car insurance policy, Budget Insurance has you spoilt for choice! With seven car insurance policies in total, there’s definitely something for any South African’s budget. If you have a newer vehicle or a larger budget, you may want to consider their Comprehensive Car, BetterCar Value, Third-Party, Fire and Theft, or Third-Party Only policies.

If your car is fully paid off or you’ve got a smaller budget for insurance, there are three ‘Budget Lite’ insurance policy options. To qualify for a Budget Lite insurance policy, your car should be worth less than R250,000. Budget Lite 1 mainly covers theft and third-party damages, while Budget Lite 2 and 3 cover written-off vehicles, third-party damages, theft and hail damage. There are also options to include your vehicle’s sound system in your cover.

Under the ‘Comprehensive Car’ option you’re covered for third-party damage, fire and explosion, own accident damage, theft and hijacking, as well as hail and flood damage. The ‘Third-Party, Fire and Theft’ policy covers third-party damage, theft and hijacking and glass damages. Lastly, the ‘Third-Party Only’ policy only covers third-party damages.

Life Insurance

Budget Insurance’s life insurance policies are offered in partnership with 1Life, with Budget Life Basic Insurance and Elevated Life Insurance being the two main policies on offer. There are several optional covers available to tailor your policy to your needs. These additional cover options include Dread Disease Insurance, Disability Insurance, Terminal Illness, Funeral Cover and Funeral Cover for older people.

The Budget Life Basic Insurance policy offers a lower payout of between R50,000 and R200,000. Whilst it is not a funeral policy, a lump sum of R50 000 is paid out within the first two days to aid in funeral-related costs. The cover does not expire based on your age and there is no waiting period for accidental deaths. There is, however, a two-year waiting period for natural and suicide-related deaths.

The Budget Elevated Life Insurance policy offers a higher cover amount of between R200,00 and R10,000,000. The cover has the same waiting periods as the basic option and also includes the initial R50,000 payout for funeral expenses. You will also receive access to confidential HIV testing, treatment and counselling if you are accidentally exposed to HIV. Lastly, you can add on a Guaranteed Assurability benefit which allows you to increase your cover amount later on in life.

Funeral Cover

Budget Insurance’s funeral cover is available in the form of individual cover, family cover, and extended family cover. The individual cover insures only the main member or policyholder. The family cover option covers the policyholder and their spouse as well as five dependents. And if that’s not enough you can get extended cover for family members that are over the age of 21.

Cover starts from R5,000 for an individual with children receiving cover on a sliding scale according to age. Natural and accidental deaths are covered, as well as HIV/Aids-related deaths. Repatriation costs are also covered, as long as the death and funeral occur within the South African borders.

Home Insurance

Ensure that you can keep your home your sanctuary with Budget Insurance’s home contents and building insurance policies. There are two main home contents insurance policies: Comprehensive Home Contents Insurance, and Fire and Storm Only Insurance.

Budget Insurance offers a Comprehensive Buildings Insurance policy. This covers the physical structure of your house and outbuildings, swimming pools, walls and fences, tennis courts, and any permanent fittings. The policy covers loss and damages due to natural disasters, malicious destruction, and theft. It also includes homeowner’s or tenant’s liability.

Under the ‘Comprehensive Home Contents Insurance’ policy, you’ll be covered for theft, loss and damage, load-shedding related damages, and homeowner’s or tenant’s liability. You’ll also receive financial compensation if you have to rent another property due to damages covered in your policy. Uniquely, this policy also covers vet bills if your pets are injured in a road accident.

The ‘Fire and Storm Only Insurance’ policy actually covers damage due to most natural disasters. This includes fires, explosions, storms, earthquakes, floods, and water damage. You will also be covered for damages due to falling trees unless the tree was deliberately felled.

Portable Possessions Insurance

Losing your prized possessions whilst out and about doesn’t have to be the end of the world. If you have an existing vehicle or home contents insurance policy with Budget Insurance, you can qualify for their portable possessions insurance policy. This policy also comes standard with their home contents offerings.

Budget Insurance offers general cover for your daily items, but you can specify more expensive items on your insurance policy. These include items like your camera, jewellery and watches, laptops, and cellphones. With these items, it’s important to value the item correctly so that you can receive enough money to replace or repair them.

Budget Insurance Headquarters and Contact Information

- Address: 1 Montgomery Drive, Auto & General Park, Block A, Mount Edgecombe, 4300

- Customer Support Phone: 0861 60 01 20

- Email: [email protected]

Frequently Asked Questions (FAQ)

How do I get a quote from Budget Insurance?

You can get a quick quote by following the prompts on their website or calling 0861 00 12 94.

How much cashback can I earn with Budget Insurance?

The ‘Cash Back Bonus’ benefit can be added to your short-term insurance policy and will pay out after two years of being claim-free. For the first two claim-free years you earn 15% of all your premiums back in cash. For the successive claim-free years you earn 10% of your premiums in cash.

How do I reduce my Budget Insurance premium?

Reducing certain risk factors and increasing your excess can lower your insurance premiums. This includes not claiming unnecessarily, taking extra security measures, and regularly reviewing your policy to ensure it still fits your needs.

Other Budget Insurance Product Reviews

Comments

No Spam, "drip-feed" or other BS email!

Get an email from us only when we can provide insights or offers.